this post was submitted on 21 Jul 2023

2064 points (98.8% liked)

Mildly Interesting

17428 readers

23 users here now

This is for strictly mildly interesting material. If it's too interesting, it doesn't belong. If it's not interesting, it doesn't belong.

This is obviously an objective criteria, so the mods are always right. Or maybe mildly right? Ahh.. what do we know?

Just post some stuff and don't spam.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

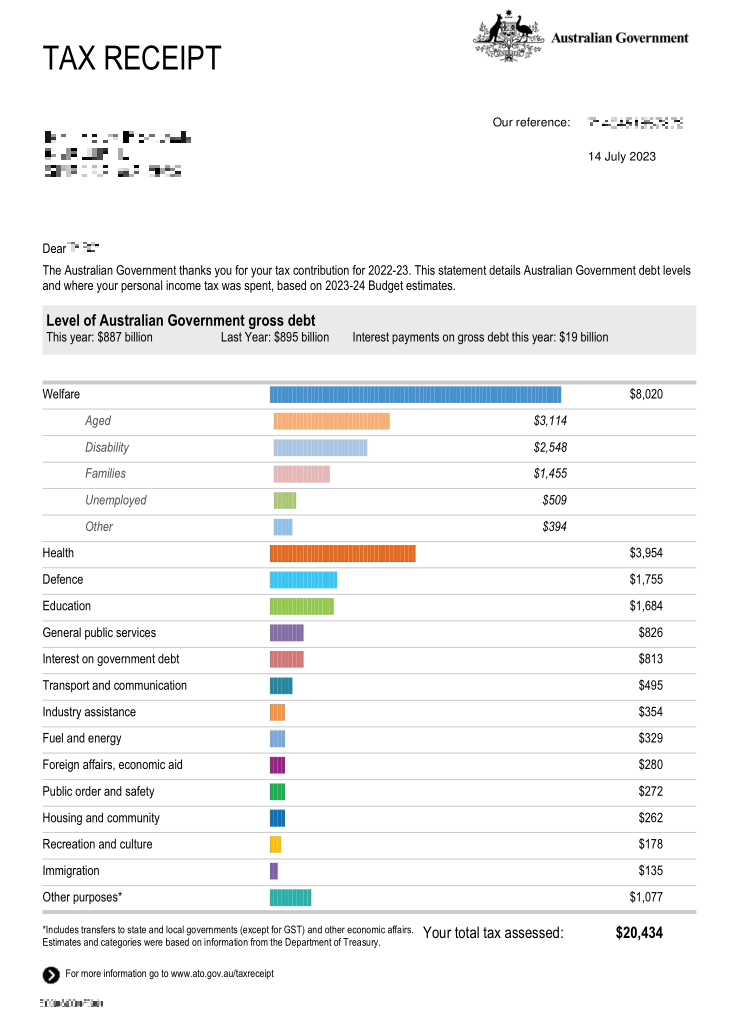

Another thing that's great about aussie tax.. you can fill it out yourself, it's very easy, all online, and it takes a very short time. They also explain every question in the form and have lots of materials that you can read. For me, I finish it each year in about 10 minutes, and never think about it again.

In the UK tax is deducted 'at source' by your employer for anybody employed. You have a personal tax code, which tells your employer how much tax to deduct and pay on you behalf.

You then have a number of allowances you can claim against if you are eligible, to reduce your tax, which issues you an updated tax code.

It is a very similar system in Australia. Must employees have their tax taken out when they are paid.

You can then claim deductions on certain things, and also make sure if you have multiple jobs you paid the correct tax.

Most people get some money back every year

In Norway, we just get it prefilled based on automatically reported data, and it's delivered by default after a certain date - you can of course make changes up until then (and retroactively up to 3 years later).

It's prefilled in Australia too, we just go through and double check it's okay and then hit submit