this post was submitted on 15 Jan 2024

1809 points (97.6% liked)

Political Memes

5613 readers

919 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

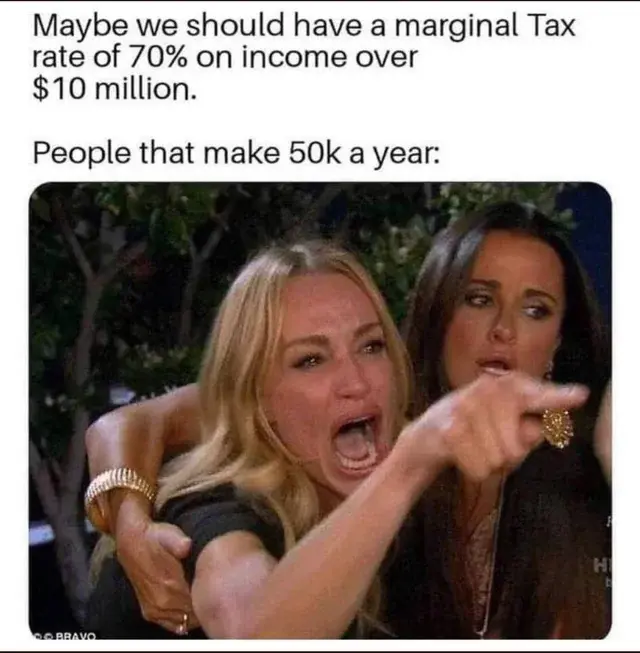

I don't know any doctor or high earning professional that makes millions of dollars per year. You're still thinking about the wrong bracket. We're talking about the mega wealthy, hundreds of millions to billions in net worth. Also, no, the effective tax rate never actually decreases in Canada. You get taxed at higher percentages the more money you make. Someone making $750k a year gets taxed at a higher rate, both marginally and effectively, than someone making $50k. You're assuming that all of this extra money is just coming from capital gains. It's not.

Fair point about marginal vs effective rates. My criticism is two points:

Those are the things where I think just increasing income tax ends up burdening the middle class the most. Adding new brackets would help, updating capital gains based on income like the US does would too, so would closing loop holes and exploring new taxation strategies.