this post was submitted on 28 Jan 2024

338 points (98.3% liked)

Greentext

4149 readers

1528 users here now

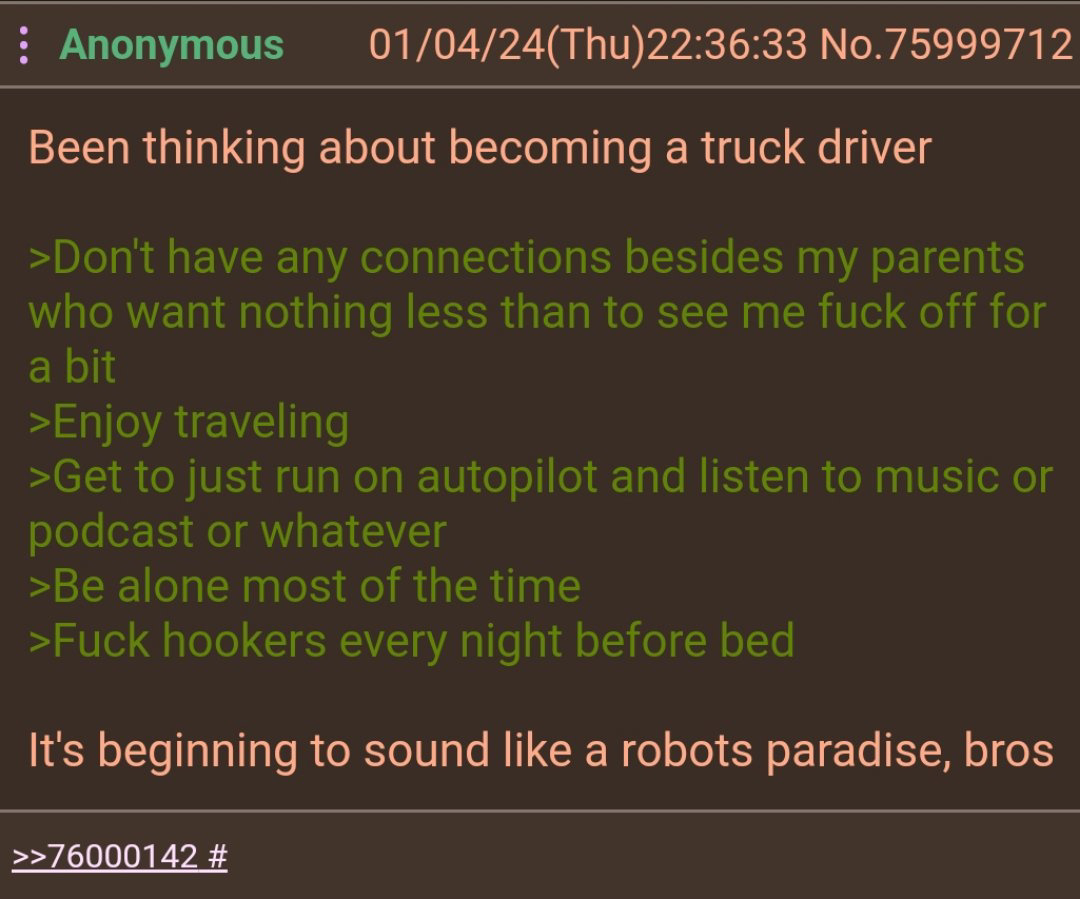

This is a place to share greentexts and witness the confounding life of Anon. If you're new to the Greentext community, think of it as a sort of zoo with Anon as the main attraction.

Be warned:

- Anon is often crazy.

- Anon is often depressed.

- Anon frequently shares thoughts that are immature, offensive, or incomprehensible.

If you find yourself getting angry (or god forbid, agreeing) with something Anon has said, you might be doing it wrong.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Yeah, I hear the pay is like oh cool I made 100k last month and spent 90k on fuel.

Well see there's multiple types of drivers.

Employee/company drivers drive the company's truck. The company pays for maintenance and fuel.

Owner Ops and Lease Ops own or lease their own truck and have to pay for fuel and other expenses.

Company drivers make anywhere from $60k-80k, maybe more on the top end of the bell curve depending on speciality, market, luck. Owners it varies wildly but usually in the 6 digits, but then they have expenses and usually end up around or a bit more than company drivers total. But they also assume all the risk.

But we also work 6+ days without break (some don't ever have days off until they go home), are away from home weeks and months at a time, have super long days, and get no overtime or wait pay.

So $10k/month and hookers every night? Still seems like a good deal.

Aren’t jobs that require you to buy your own fuel 1099 or something? Doesn’t seem worth it? What about if taxes are deducted? Does it pay better?

So a 1099 allows you to deduct work related expenses. It’s the difference between being an actual employee, which has both labor law and tax implications vs a contractor. So if you make 100k, and you spend 20k on fuel, your taxable income is actually 80k.

The trade off is you can’t take the standard deduction which is like 12k for singles now? Double if married. If you itemize expenses, and you have to document and track those expenses. There’s also a higher risk of you getting audited by the IRS.

So the short answer is as long as you can deduct more than you would have been able to with the standard deduction, it can be worth it. But then you get slapped with “self employment tax” or whatever bullshit it’s called.

This is over simplified and I’m not any kind of expert.

This is the same kinda thing the wealthy use to dodge taxes. The trump method is “lose so much fucking money that you can have net 0 income for years”.

Quick edit: if you file a W2, there’s a 90% chance you take the standard deduction by default

Yeah i know what 1099 means, just not the details of deductions. I’m saying fuel costs a lot lot; it costs hundreds? to fill a big rig? So the deductions can’t possibly make up for it? Unless you’re never off the road? I know there’s long haul and local short jobs, I’m just trying to get a picture. Doesn’t seem worth it. Plus driving gets hard on hands, arms, neck, back and butt so add in medical issues from years of it.

You can deduct fuel, you can deduct t any food bought while working, you can deduct the depreciation of the truck itself which on those big rigs can be significant.

Spending 12k in expenses wouldn’t take very long at all I imagine

I mean, that's what practically any business is like.

10k leftover per month would be 120k per year, which is actually quite a bit above median income in the US