this post was submitted on 09 Feb 2024

728 points (96.2% liked)

tumblr

3441 readers

1028 users here now

Welcome to /c/tumblr, a place for all your tumblr screenshots and news.

Our Rules:

-

Keep it civil. We're all people here. Be respectful to one another.

-

No sexism, racism, homophobia, transphobia or any other flavor of bigotry. I should not need to explain this one.

-

Must be tumblr related. This one is kind of a given.

-

Try not to repost anything posted within the past month. Beyond that, go for it. Not everyone is on every site all the time.

-

No unnecessary negativity. Just because you don't like a thing doesn't mean that you need to spend the entire comment section complaining about said thing. Just downvote and move on.

Sister Communities:

-

/c/TenForward@lemmy.world - Star Trek chat, memes and shitposts

-

/c/Memes@lemmy.world - General memes

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

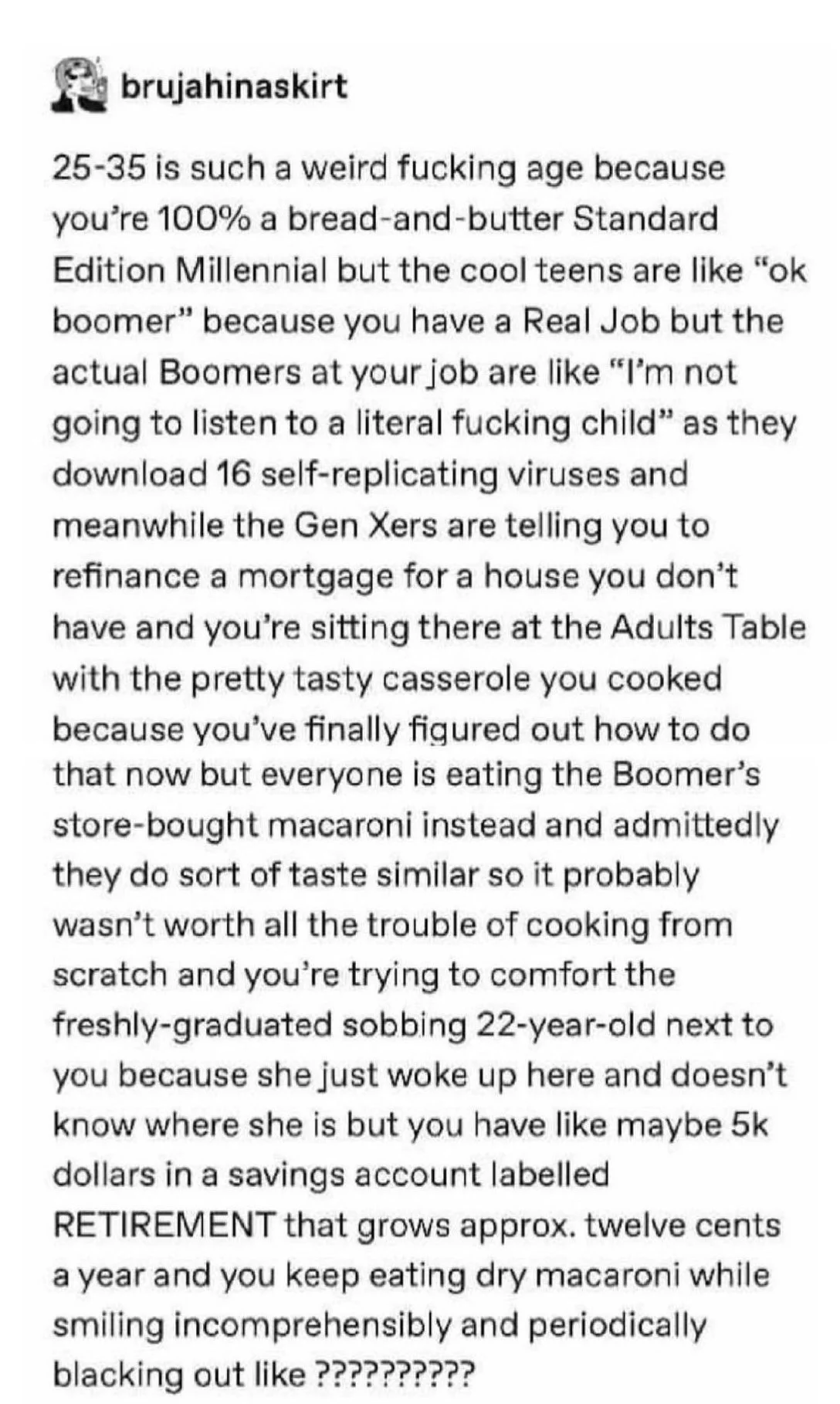

Similarly if your savings account is netting you cents a year. Learn to invest. 5000 is an ok start if you're still young.

Edit: Like the comment below says, I'm not saying it's easy. It's not meant as an insult but as advice.

I didn't open an account myself until actually relatively recently and I'm in my 40s now. I come from a working class background. No one in my family ever invested and it never occurred to me that it was an option. I wish I'd started 10 or 20 years ago.

Common consumer savings accounts at major banks like Wells Fargo are useless and pathetic compared to what they were. You could get almost 8% in the 1980s. It's in the decimals for the vast majority of consumer accounts at the balances 95% of the people have. 0.25% isn't uncommon, and neither is 0.01%.

You might be able to get ~5% on a high yield savings account if you can find one that doesn't have too many restrictions. A decent CMA at a brokerage will probably get somewhere between 2-5%, and many of them operate just like regular checking with debit carts and the like.

Sure, the Big Banks are convenient with ATMs everywhere and all that, but thanks to the vast majority of transactions being electronic, that convenience matters less and less every day.

E: people are sharing banks they know of with good rates, check them out or your local credit union. Stay away from Big Consumer Banking. Their rates are junk.

Interest rates for savings are heading back up. There's two separate credit unions near me with 5% interest on checking accounts and a couple online banks offering a 2-3% on savings with little requirements. CDs still suck though, some have rates in the 5%+ range, but generally require 20-50k minimum balance, which is absurd.

Wealthfront checking account has 0 restrictions and pays 5% APY. Same day withdrawals. No minimums. No fees. 8M FDIC insurance. So does SoFi. Ally...

I don't know why you were downvoted, it's true. This isn't like a bootstraps judgement thing, this is just good advice- high yield savings accounts now are like 4% interest, so that's $200 / yr on that $5k.

When i got my first job, there was this older guy, Brad. older than the rest of us shithead teens i mean, like 25. He was pretty cool, but he had braces, which was unusual for someone his age.

The cinema we cleaned was in a fancier part of town. Brad and i were actually the only couple of dudes from the other side of the tracks. Not poor, right? But not fancy.

Anyway one day one of the other kids we worked with, a fancy chick called Kelly asked him

she said. continued

Depends on how much you need to draw into that 5k. Liquidity is pretty important too, and you don't want to have to worry about short sales.

I mean yeah but if you need it for your day to day it's not really savings. It's tough out there no doubt of course.